An individual is tax resident in the Republic if he spends more than 183 days in the Republic in total in a tax year.

An individual can be a tax resident of the Republic even if he/she spends less than or equal to 183 days in the Republic if he/she satisfies ALL the following conditions within the same tax year

a) Does not spend more than 183 days in any other country

b) Is not a tax resident of any other country

c) Spends at least 60 days in the Republic

d) Maintains a permanent home in the Republic that is either owned or rented

e) carries on a business in the Republic, is employed in the Republic or holds an office in a person who is ta resident of the Republic at any time during the year

- An individual that is tax resident in Cyprus is taxed on income arising from sources both within and outside the Republic.

- An individual that is not tax resident in Cyprus is taxed on income arising from sources within the Republic.

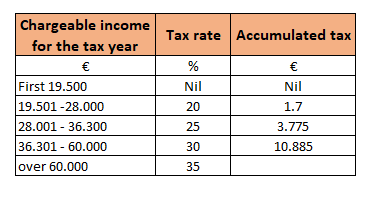

Personal tax rates

The following income tax rates apply to individuals:

Some income are exempt from income tax:

a) Dividend Income Whole amount

b) Interest income Whole amount

c) Profit from the disposal of securities Whole amount

Obligations of an individual

Every individual whose gross income exceeds €19,500 in a year need to submit electronically the TD1 though ‘’Taxisnet System’’

TAX RESIDENCE IN CYPRUS-COMPANY

A company is tax resident in the Republic if it is managed and controlled from the Republic that means:

a) the majority of the directors are in Cyprus

b) the majority of the board meetings are held in Cyprus and

c) the majority of the decisions are taken in Cyprus

- Where a company is resident in Cyprus, tax is imposed on income accruing or arising from sources both within and outside the Republic.

- Where a company is not resident in Cyprus, tax is imposed on income accruing or arising from sources within the Republic.

The corporate income tax rate is 12,5%. This is one of the lowest corporate taxes in the EU and possibly one of the best worldwide.

Some income are exempt from corporate income tax:

a) Dividend Income Whole amount

b) Interest income Whole amount

c) Profit from the disposal of securities Whole amount

Obligations of a company

- Every company need to pay every year to register to company the amount of €350 until of 30th of June.

- Every company need to prepare financial statements and submit electronically the company tax return (TD4) until 31st of March each year.

- Calculation of provisional tax and payment of two installments for the provisional tax return of the year, one on 31st of July and 31st of December.

- Every company that has staff need to electronically submit every year until 31st of July the employer’s return (TD7)

SPECIAL CONTRIBUTION FOR DEFENCE

The persons that are subject to special contribution for defence are:

a) Cyprus tax residence companies

b) Individuals who are tax resident and domiciled in Cyprus

Domiciled for the purposes of Special contribution for defence:

- if the individual has a domicile of origin in Cyprus based on the provision of the Wills and Succession Law or

- if the individual has been a tax resident in Cyprus for at least 17 out of 20 years immediately prior to the tax year of assessment

Rate | |

a) Dividends income | 17% |

b) Interest income | 30% |

c) Interest income from Cyprus | 3% |

d) Government bonds/Saving Certificates | 3% |

e) Interest income by approved provident fund | 3% |

f) Interest income by Social insurance fund | 3% |

*Every person who is tax resident and domiciled in Cyprus and earns Rental income is subject to defence contribution at the rate of 3% in the gross rental income reduced by 25%.

Obligations:

1) Every company need to pay special contribution for defence withheld on dividends, interest or rent in one month from the day of the payment of dividends, interest or rent and prepare the form TD601.

2) Every company/individual need to pay special contribution for defence on rents and dividends received for the first 6 months of the year until 30 June of every year and prepare the form TD601.

3) Every company/individual need to pay special contribution for defence on rents and dividends received for the last 6 months of the year until 31 December of every year and prepare the form TD601.

CAPITAL GAINS TAX

Capital gain tax is imposed at the rate of 20% on :

a) Gains from the sale of immovable property situated in the Cyprus

b) Gains from the sale of shares of companies that own immovable property situated in Cyprus and are not listed on a recognized stock exchange.

c) Gains from the sale of shares of companies that indirectly own immovable property situated in Cyprus and derive the 50% of their market value from such immovable property.

Does not matter if you are a Cypriot of foreigner if you sell a property you owned in Cyprus you are liable to pay Capital Gains Tax.

However, individuals can claim the following lifetime deduction:

- Up to €85,430 if the disposal relates to a main private residence.

- Up to €25,629 if the disposal is made by a farmer and it relates to agricultural land.

- Up to €17,086 on any other disposal

These deductions are granted once in the lifetime of the individual, until fully exhausted and if an individual claims a combination of them, the maximum deduction granted cannot exceed €85,430.

Capital gains tax - exemptions

Under the law, certain disposals are not subject to Capital Gains Tax:

- Transfers arising on death

- Gift between spouses, parents and children and up to third degree relatives

- Gifts to a company where the company shareholders are members of the donor’s family and the shareholders continue to be members of the family for five years after the date of the transfer

- Gifts by a family company to its shareholders provided such property was originally donated to the company. However if the shareholder disposes the property within 3 years then the shareholder will not be entitled to the deductions listed below

- Gifts to charities and the Government

- Exchange of Cyprus properties ( under certain conditions)

- Expropriations

- Transfer as a result of reorganizations (under certain conditions)

- Transfer under a qualifying loan “Restructuring” (under certain conditions)

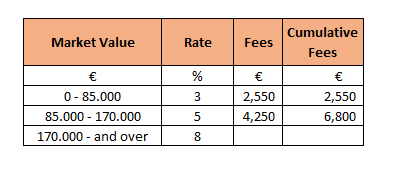

Transfer fees for the immovable property

Transfer fees are payable by the purchaser for registering the acquired property on his/her name to the Department of Land and Surveys.

Transfer fees are calculated on the market value of the property the day of acquisition:

Note:

1) No transfer fees are payable if the transfers are subject to VAT (new building)

2) The above transfer fees are reduced by 50% in case the purchase of immovable property is not subject to VAT.

3) For free transfers of property between the following parties the rates for the transfer fees are changes to the following :

- From parents to children 0%

- Between spouses 0,1%

- Between third degree relatives 0,1%

4) Transfer under qualifying reorganization or Restructuring is 0%.