What tax do I need to pay when I receive the rental income from Cyprus?

22 Jul 2021

What tax do I need to pay when I receive the rental income from Cyprus?

Rental income earned from immovable property situated in Cyprus or abroad, received by a Cyprus tax resident person (company or individual), is subject to the following:

A) Income tax

B) Special defence contribution

C) National Health System Contributions

Rental income earned from immovable property situated in Cyprus by i) individuals tax resident but non-domiciled in Cyprus and ii) non-Cyprus tax residents are only subject to:

A) Income tax

B) National Health System Contributions

| INCOME/CORPORATE TAX | SPECIAL DEFENCE CONTRIBUTION | National Health System Contributions | |

|---|---|---|---|

| Tax resident individual | The gross worldwide rental income, after a 20% exemption and certain allowable deductions, is summed up with all other taxable incomes of that person and taxed in accordance with the Cyprus personal income tax band rates* | Gross worldwide rental income taxed at the rate of 3% after an exception of 25% | Gross worldwide rental income taxed at the rate of 1.7% from 1.3.19-31.5.20 and 2.65% from 1.6.20 and afterwards |

| Non-Tax resident individual | The gross rental income earned from Cyprus properties, after a 20% exemption and certain allowable deductions, is summed up with all other Cyprus taxable incomes (if any) and taxed in accordance with the Cyprus personal income tax band rates* | N/A | Gross rental income earned from Cyprus taxed at the rate of 1.7% from 1.3.19-31.5.20 and 2.65% from 1.6.20 and afterwards |

| Cyprus Tax resident Company | Gross worldwide rental summed up with all other taxable incomes and tax allowable expenses of the company. The resulting profit is taxed at the rate of 12.5%* | Gross worldwide rental income taxed at the rate of 3% after an exception of 25% | Gross worldwide rental income taxed at the rate of 1.7% from 1.3.19-31.5.20 and 2.65% from 1.6.20 and afterwards |

| Cyprus Non-Tax Resident Company | Gross rental income earned from Cyprus properties is pooled with all other Cyprus taxable incomes (if any) and after deduction of tax allowable expenses the resulting profit is taxed at the rate of 12.5%* | N/A | Gross rental income earned from Cyprus taxed at the rate of 1.7% from 1.3.19-31.5.20 and 2.65% from 1.6.20 and afterwards |

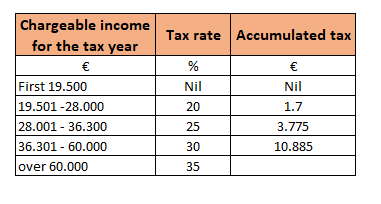

*The personal income tax rates for individuals are below:

- Every individual whose gross income exceeds €19,500 in a year need to submit electronically the TD1 though ‘’Taxisnet System’’ and pay the income tax.

- For companies the rate is fixed to 12.5% on the taxable profit.