Do I need to pay the special defense tax on rental, dividends and interest income?

22 Jul 2021

Special Defence contribution is imposed on dividend income, interest income and rental income earned by companies’ tax resident in Cyprus and by individuals who are both Cyprus tax resident and Cyprus domiciled.

Special contribution for defence is imposed on the following sources of income:

Rate |

|

a) Dividends income |

17 |

b) Interest income |

30 |

|

c) Interest income from Cyprus Government bonds/Saving Certificates |

3 |

d) Interest income by approved provident fund |

3 |

e) Interest income by Social insurance fund |

3 |

f) Rental income* |

3 |

*Every person who is tax resident and domiciled in Cyprus and earns Rental income is subject to defence contribution at the rate of 3% in the gross rental income reduced by 25%.

Liable for special contribution for defence or not |

||

| 1. | Companies that are tax resident in Cyprus |

Taxable |

| 2. | Individual that are tax resident and domiciled |

Taxable |

| 3. | Individual that are tax resident but not domiciled |

Exempt |

Tax Residency Certificates – 183 days rule or 60 days rule

The Cyprus Tax Department (CTD) has issued a circular and it is possible for Cyprus tax resident individuals to request and obtain a tax residency certificate at any time during the tax year for which the certificate is requested. Most people may need this certificate to benefit from the provisions of Double Tax Treaties between Cyprus and third countries, so as not to suffer withholding tax at source upon receipt of income from sources outside Cyprus.

Individuals can apply for a certificate of tax residence at any time. The form T.D. 126 2017 must be completed. A person that will apply for the certificate need to have all the needed documentation to prove that it was in Cyprus for period needed based Cyprus Tax.

Domicile in Cyprus

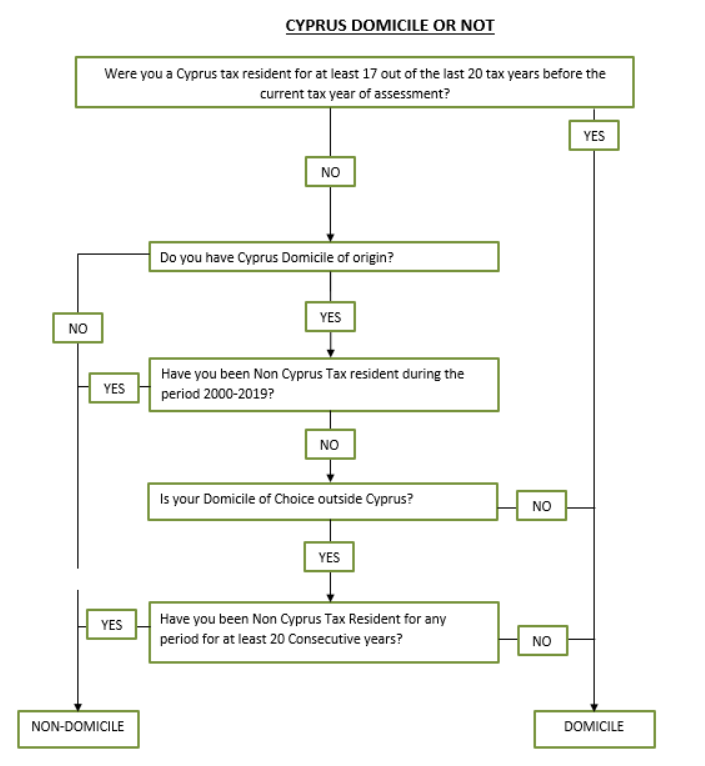

According to the rules of the Wills and Succession Law a person is domiciled in Cyprus

- If he is a resident of Cyprus for a period of at least 17 years out of the last 20 years prior to the tax year of assessment or

- If he has a domicile-of-origin in Cyprus (with some exceptions please see the flowchart)

Note:

Need to be very careful when you declare in any form in Cyprus your status (resident/domicile) because based the information you declare they will deduct from your income the relevant tax.

For example:

- If you have a note in a bank account in Cyprus and you mentioned that you are a Cyprus tax resident and domiciled in Cyprus any interest income you would receive will be reduced by a special defence contribution of 30%. However, if you inform them that you are not you will be except from Special defence contribution and no defence will be deducted at source.

- If you purchased bond from Government and you mentioned that you are a Cyprus tax residence and domiciled in Cyprus any interest income you would receive will be reduced by a special defence contribution of 3%. However, if you inform them that you are not you will be except from Special defence contribution and no defence will be deducted.